Claim Management Agent with fraud detection

Claim management and fraud detection for insurance companies

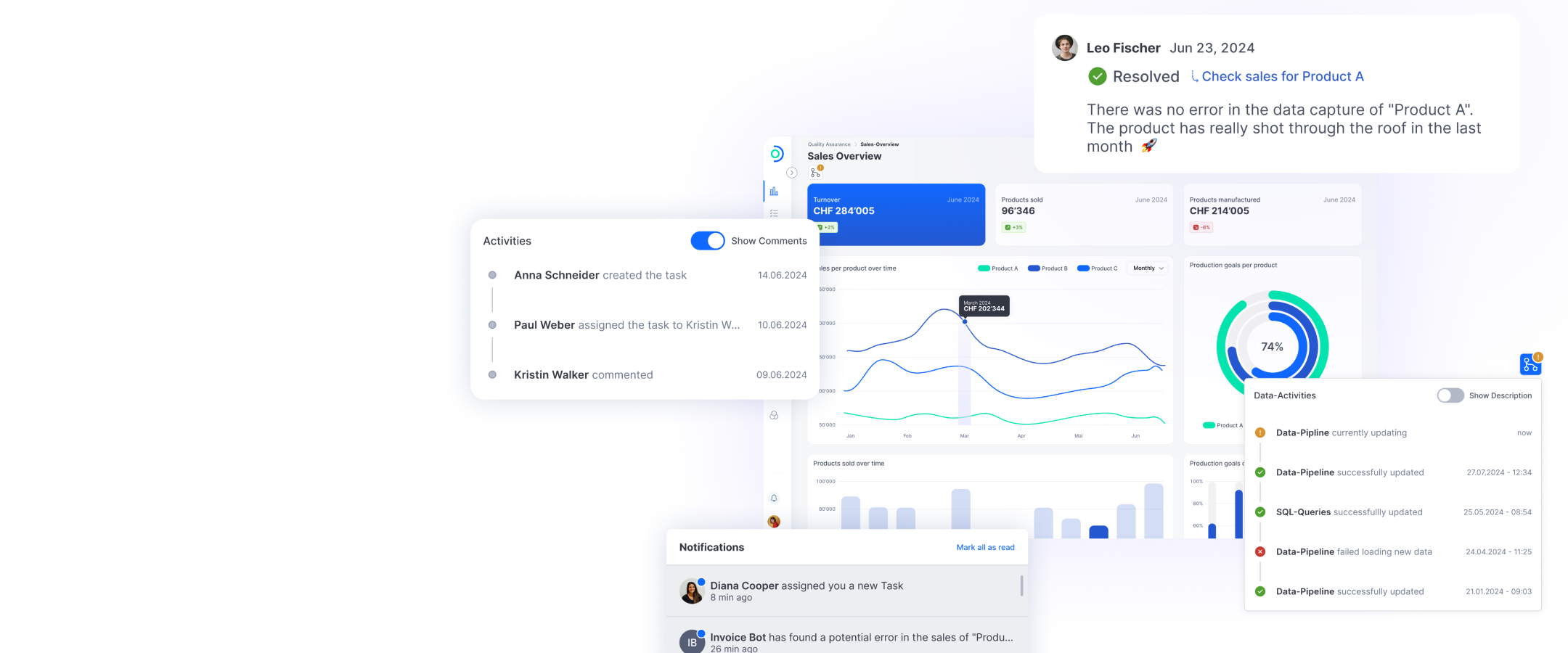

A Claim Management Agent automates the entire claim management process and recognizes suspicious claims with its integrated fraud detection feature. It is fast, accurate, and provides full justification for its conclusions.

Intelligent claims management and fraud detection in seconds

Fraud costs insurers huge sums every year. An AI-supported Claim Management Agent recognizes suspicious claims as they are reported and so reduces fraud costs.

Equipped with deep learning, anomaly detection, deepfake analysis, and multimodal foundation models, the Agent checks every report for plausibility—from image analysis and geo-checks to cost estimates—always providing transparent reasoning. The result: efficient support for claims handlers throughout the entire claim management process and a powerful protective shield against fraud that detects substantially more suspicious claims than conventional systems.

Benefits for insurers

Reliable fraud detection

Cost reduction through speed

Support for existing processes

Locally developed, locally operated

This is how a Claim Management Agent can operate

Head of AI & Digital Solutions

Lisa Kondratieva

Detect fraud faster, streamline operations, and cut costs—with AI that adapts to your insurance company’s specific needs.